In the first quarter of 2024, global economic growth continued to slow down, showing a complex and ever-changing pattern amidst multiple risks and uncertainties; Under the coordinated efforts of macroeconomic policies, the domestic economy has achieved a good start and is showing a stable and positive trend. The economic operation of China's industrial textile industry is showing a recovery and steady recovery trend. The industrial added value of the industry continues to grow, and many major economic indicators are rebounding and showing signs of export recovery.

In terms of production, according to data from the National Bureau of Statistics, the demand for non-woven fabrics in the market continued to recover from January to March, and the industry started operating well. The non-woven fabric production of enterprises above designated size increased by 9.7% year-on-year; From January to March, automobile production and sales were booming, driving a year-on-year increase of 17% in curtain fabric production for enterprises above designated size, continuing to maintain double-digit growth.

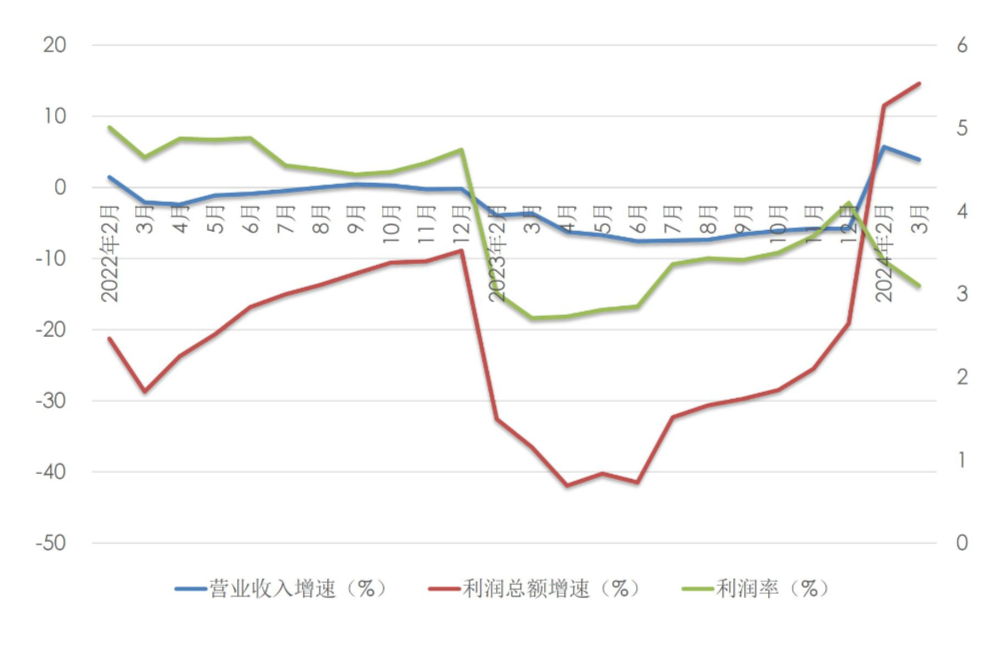

In terms of economic benefits, according to data from the National Bureau of Statistics, the operating revenue and total profit of enterprises above designated size in the industrial textile industry increased by 3.9% and 14.6% year-on-year from January to March, respectively. The industry's profitability has significantly improved, with an operating profit margin of 3.1%, a year-on-year increase of 0.3 percentage points.

Looking at different sectors, the operating revenue of non-woven fabric enterprises above designated size from January to March was basically the same as that of the first quarter of 2023, but their profitability continued to be under pressure. The total profit decreased by 24.4% year-on-year, and the operating profit margin was 1.6%, a decrease of 0.5 percentage points year-on-year; The rope, rope, and cable industry continues to maintain a good development momentum, with the operating revenue and total profit of enterprises above designated size increasing by 21.7% and 79.8% year-on-year, respectively, at the highest level in the industry. The operating profit margin is 2.3%, a year-on-year increase of 0.7 percentage points; The operating revenue and total profit of enterprises above the scale of textile belts and curtain fabrics increased by 3.9% and 20.8% year-on-year, respectively, with an operating profit margin of 1.9%, a year-on-year increase of 0.3 percentage points; The operating revenue of enterprises above the scale of canopy and canvas decreased by 0.4% year-on-year, with a total profit increase of 27.4% year-on-year. The operating profit margin was 5%, with a year-on-year increase of 1.1 percentage points; The operating revenue and total profit of textile enterprises above designated size in other industries where filtering and geotextile textiles are located increased by 12.1% and 42.3% year-on-year, respectively, with a 6% operating profit margin at the highest level in the industry.

Growth rate of major economic indicators in the industrial textile industry from January to March 2024

Data source: National Bureau of Statistics, China Industrial Textile Industry Association

In terms of international trade, according to Chinese customs data (8-digit HS code statistics), the export value of China's industrial textile industry from January to March 2024 was 9.83 billion US dollars, a year-on-year increase of 2.8%; The industry's import volume from January to March was 1.13 billion US dollars, a year-on-year decrease of 8%.

From a product perspective, industrial coated fabrics are the largest export product in the industry, with an export value of 1.2 billion US dollars, a year-on-year increase of 10.5%; The export value of felt fabric/tents was 1.13 billion US dollars, with a fluctuation in export growth rate, a year-on-year decrease of 1.4; The overseas demand for non-woven fabrics continues to recover, with an export volume of 344000 tons, a year-on-year increase of 18.3%, and an export value of 970 million US dollars, a year-on-year increase of 7.2%; The export value of disposable sanitary products (diapers, sanitary pads, etc.) was 820 million US dollars, a year-on-year increase of 3.5%, of which the export value of adult diapers increased by 18% year-on-year; In traditional products, the export of canvas, leather based fabrics, and industrial fiberglass products has increased to varying degrees, while the export value of wire rope (cable) belt textiles and packaging textiles has slightly decreased year-on-year; The overseas market for wiping materials remains active, with the export value of wiping cloths (excluding wet wipes) reaching 390 million US dollars, a year-on-year increase of 21.9%, and the export value of wet wipes reaching 220 million US dollars, a year-on-year increase of 37.8%.

Currently, the international economic environment still faces complexity and uncertainty, but some leading indicators show that the global economy is recovering. In March, the global manufacturing purchasing managers index was 50.6%, marking the third consecutive month of recovery; The overall domestic economy is showing a recovery trend, with steady growth in industrial production. Driven by the implementation of various consumption promotion policies and measures, the consumption potential is accelerating its release. Looking ahead to the second quarter, favorable factors supporting the stable start of the economy in the first quarter will still play a role, especially the implementation of policies related to promoting large-scale equipment updates and the action plan for exchanging old for new consumer goods, which will have a positive impact on related industries. However, the industry still needs to be vigilant about the impact of weak terminal consumption and supply-demand imbalances in some areas, and the industry's profitability still faces certain pressure; Global trade is showing signs of stabilization and improvement. The contraction of global trade in 2023 has given rise to new demand for restocking in various countries, and industry exports are expected to continue to grow in the short term. It is expected that the industrial textile industry will maintain a stable recovery trend in the second quarter of 2024, and the production and sales of the industry will continue to maintain a reasonable growth range. The industry's exports will maintain a medium to low growth rate.

(Source: China Industrial Textile Industry Association)