Since 2023, the world economy has exhibited a new feature of "three highs and one low" (high core inflation, high interest rates, high risk, low growth) due to the impact of multiple factors such as the escalation of geopolitical conflicts, high global inflation, and the reconstruction of the global industrial supply chain. Our country is facing multiple challenges such as the lack of strength in the world economic recovery, frequent domestic natural disasters, and the difficulty of reform, development, and stability tasks, resulting in a fluctuating macroeconomic development and a zigzag recovery process. The industrial textile industry in our country is still in a recovery and adjustment phase after the extraordinary growth in 2020, with the production of major products maintaining steady growth. However, influenced by the decline in market demand in some key sub-sectors and intensified competition between companies, the industry's sales, profits, imports and exports, and investments have all shown varying degrees of decline.

Production capacity utilization has steadily recovered, and the production of major products has steadily increased. In 2023, the industrial textile industry in our country continues to adhere to the concept of high-quality development, and the production of major products has steadily increased. The annual production capacity utilization rate of the industrial textile industry has steadily recovered, and according to surveys of sample companies conducted by the association, the production capacity utilization rate of sample companies in 2023 was about 75%, an increase of 2.5 percentage points from the first half of the year, with over 40% of sample companies having a production capacity utilization rate exceeding 80%. According to statistics from the association, the total fiber processing volume of China's industrial textile industry reached 20.341 million tons in 2023, an increase of 3.8% compared to the same period last year. As a major raw material for industrial textiles, the production of non-woven fabrics in China was 8.143 million tons, similar to 2022.

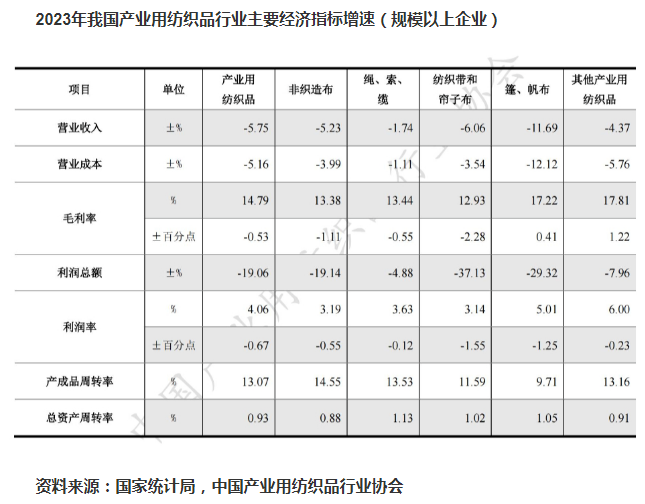

The industry's profitability is under pressure, and the differentiation of companies is further accelerating. In 2023, the economic operation of the industrial textile industry showed a trend of ups and downs. According to data from the National Bureau of Statistics, the operating income and total profits of large-scale enterprises in the industrial textile industry (non-caliber) in 2023 decreased by 5.8% and 19.1% year-on-year, respectively, with the decrease narrowing by 1.8 and 22.4 percentage points from the first half of the year. Particularly, the major economic indicators since December have shown a significant rebound. Overall, the profitability of industry enterprises is generally under pressure, with an operating profit margin of 4.1%, which, despite increasing by 1.2 percentage points from the first half of the year, was the lowest in the past decade.

When viewed by sector, according to data from the National Bureau of Statistics, in 2023, the operating income and total profits of enterprises in China's non-woven fabric industry above a certain size decreased by 5.2% and 19.1% year-on-year, respectively. The growth rate of total profits decreased significantly by 46.8 percentage points from the first half of the year, with gross profit margins and operating profit margins at 13.4% and 3.2%, respectively, increasing by 1 point and 2 points from the first half of the year.

For enterprises in the rope and cable industry above a certain size, operating income and total profits decreased by 1.7% and 4.9% year-on-year, with gross profit margins and profit margins at 13.4% and 3.6%, respectively, decreasing by 0.6 points and 0.1 points from the previous year.

For enterprises in the spinning belt and curtain cloth industry above a certain size, operating income and total profits decreased by 6.1% and 37.1% year-on-year, with a gross profit margin of 12.9%, a decrease of 2.3 points from the previous year, and a profit margin of 3.1%, a decrease of 1.6 points from the previous year.

For enterprises in the canvas and sailcloth industry above a certain size, operating income and total profits decreased by 11.7% and 29.3% year-on-year, with a gross profit margin of 17.2%, an increase of 0.4 points from the previous year, and an operating profit margin of 5%, a decrease of 1.3 points from the previous year.

For other industrial textile industries where geotextiles and filtration fabrics are located, operating income and total profits of enterprises above a certain size decreased by 4.4% and 8% year-on-year, with gross profit margins and operating profit margins reaching 17.8% and 6%, respectively, both at industry-leading levels.

Industry investments are cautious, and high-quality investments remain active. In 2023, enterprises in the non-woven fabric industry are cautious about investing in new projects, with over 45% of sample companies not investing in new projects or construction throughout the year. According to incomplete statistics, in 2023, China saw an increase of approximately 45 new production lines for spunbond and melt-blown non-woven fabrics, 25 new production lines for spunlace non-woven fabrics, and 135 new production lines for needle-punched non-woven fabrics, with a total new production capacity exceeding 850,000 tons.

Regarding investment plans for 2024, according to the association's survey, the investment enthusiasm of sample companies shows clear signs of recovery compared to 2023, with over 70% of companies having new project investment plans for 2024. Among the sample companies with investment intentions, the investment proportion for upgrading existing equipment, constructing factories, and intelligent green transformation has generally increased compared to 2023, indicating that industry enterprises continue to be active in high-quality investments.